If you’ve watched the movie The Shawshank Redemption you might remember the scene in which the character Red, an inmate played by Morgan Freeman, is asked by a parole board if he believes he’s been ‘rehabilitated’.

There are earlier scenes in which he’s been asked the same question and tried to give the perfect answer, only to be denied parole. But the specific scene that’s on my mind now is near the end of the movie when Red is an older and wiser man.

He has grown indifferent over time and has also come to recognize that what he has to say really doesn’t matter very much. He tells them he thinks the word ‘rehabilitated’ is essentially a silly, made-up word they can use to hide behind no matter what they decide to do with him. Red had heard the word before, and his experience has taught him that it can be twisted and used in just about any way they want. To him, it’s a fancy word with very little relevance.

I won’t go any further for fear of ruining the movie for anyone that hasn’t seen it yet. But I wanted to use this Shawshank reference to illustrate how sometimes the financial world throws around words and phrases in similarly arbitrary ways. In ways that the words might mean something to the people speaking them but be mostly meaningless to the people hearing them.

I recognize this isn’t a perfect analogy, but words like ‘recession’ and ‘bear’ are thrown around by the financial crowd in ways that are reminiscent of how ‘rehabilitated’ probably sounded to Red.

In an Econ 101 textbook, a recession is defined as the occurrence of two consecutive quarters of negative GDP growth. And in Wall Street parlance, a bear market is when any given asset retreats at least 20% from its recent high point.

Those are the technical definitions. But what do these words really mean?

Is it possible they have as little relevance to investors as the word rehabilitated had to Red in Shawshank?

While these are significant words academically, my experience shows that their relevance to investors is much more emotional than it is financial.

Let me explain.

We’ve all heard that perception is greater than reality. So how something feels is ultimately more important that how it is defined.

In this context, my point is that it doesn’t matter if the overall economy enters a recession if the prevailing emotion in the air is that one is imminent. Behaviors of consumers don’t change because we’ve met the definition of a recession; their behaviors change if they feel less confident in a brighter tomorrow.

And when the consumer slows down, it’s harder for companies to sell their products at profitable prices. This is reflected in corporate earnings that might not be as strong as expected, and this leads to struggles in the stock market.

This pattern can play out without a recession ever having occurred.

I point this out because I see a lot of people thinking it is important to properly guess whether the economy will enter a recession or not. They seem to believe there is a black and white reality in which stocks do badly if we have a recession but do just fine if we don’t. I disagree with this simple opinion and think it’s important to know that the sour sentiment that spreads with the constant concern about a recession has a negative impact regardless.

This takes us to a quick exploration of whether entering a bear market truly matters. Again, I would downplay the significance of the definition and focus more on the nuance.

As I type this, the S&P 500 and Dow Jones are in corrections (a dip of 10%+) and the Nasdaq, which is largely technology driven, and the Russell 2000, which tracks middle and smaller sized companies, are in bear markets (down 20%+). These are the most followed indexes in the markets, but they don’t tell the full story. There are many sectors within the indexes that are down far greater. And there are loads of household name companies whose stock prices have fallen as much as 30% – 50%+ (names like PayPal, Boeing, Facebook, Disney, and more). My point here is that the indexes can mask the deeper reality. And in my days, I’ve seen several periods when the average stock within the market fell much more than the indexes would ever indicate at face value; meaning pain was felt regardless of whether a properly defined bear market was experienced.

My point with this is that words and phrases don’t define an investor’s reality. After all, your reality is defined by how you are impacted, regardless of irrelevant labels.

This edition of Worth Considering is a call to confirm your financial status overall and specifically what your exposure to the investment markets means to you, your retirement, and your legacy.

In essence, how much does what is happening in the current moment in the markets matter to your prioritized goals?

I’ll briefly touch on the major risks being digested by the markets now and will then circle back to what I expect and exactly what you might want to consider doing about it.

This isn’t a complete list, but the markets are currently wrestling with the war in Russia and Ukraine, the latest outbreak of Covid in China, the fears of worldwide inflation, concerns about interest policies set by the Federal Reserve, the lackluster return of the workforce, and the state of the consumer in the face of all this uncertainty.

When I first sat down to draft this piece, I’d drafted a few paragraphs of commentary on each of these topics. The result was an extremely long and boring dissertation about geo-politics and government policy.

Ironically, it was a long piece with limited relevance!

It also ran the risk of losing the primary point I want to make about the personal nature of your exposure to the financial markets, so I cut it all out. The vast majority of you reading this are likely thankful; but those of you that might want to connect to dig into those details more deeply, please feel free to give me a call.

The summation of all my deleted thoughts is that this list of risks is real and will take time for the markets to address. I do not believe our economy is set to spin out of control or be annihilated by hyper-inflation. But I do believe these risks are elevated and won’t be immediately resolved. Again, don’t hesitate to reach out to me if you’d like to explore my reasonings.

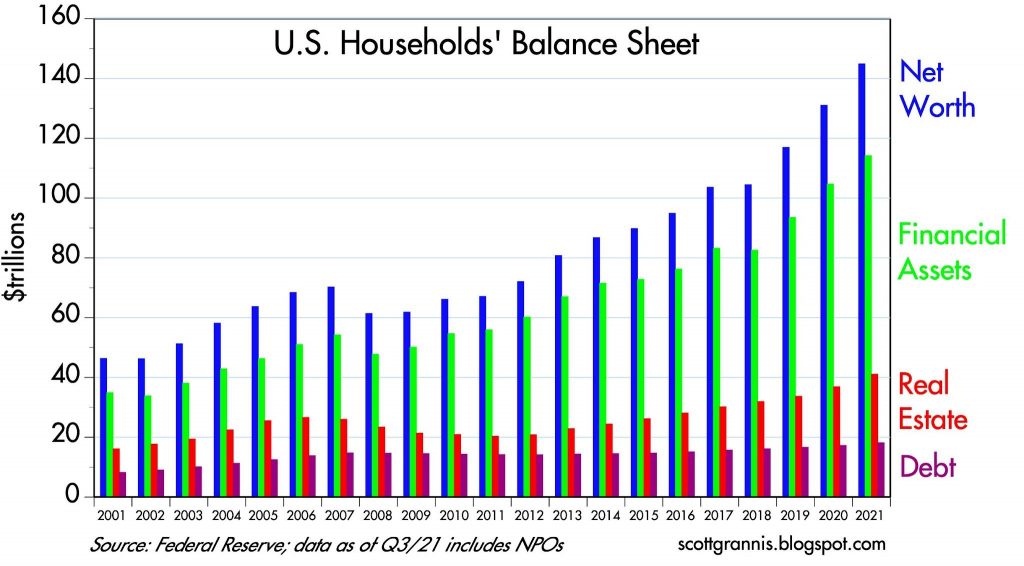

There is only one graph that I have chosen to keep, and that’s because it carries some uniquely good news that I don’t think gets enough attention. It is all about the personal responsibility taken by the typical US Household.

A common perception is that we have a country laden with debt. We don’t. While we have a government that has a problem with debt, the same can’t be said of the broader population. And since our economy is largely consumer driven, monitoring the financial health at a household level is often more important than any other metric.

Look at this graph below. The data is a couple quarters old, but the monthly data that has been released ever since confirms the same story – that the consumer is carrying some of the lowest amounts of debt ever. As you see from the purple lines, the nominal amount of debt on Household America’s balance sheet has hardly risen at all while their overall net worth has continued to increase. This means their debt-to-equity ratio is only getting better. This instills confidence. It doesn’t mean the consumer won’t pull in their horns if they grow weary of the headlines of the day; but it does mean that they are likely to still have plenty to spare to spend as a defense against persistent inflation. The bottom line is that any economic weakness is likely to be muted by the healthy starting point of the consumer.

As I said, I wanted to keep these prior thoughts abbreviated so there’s less risk of losing the main point, which is all about your personal financial situation and whether or not you have the most appropriate amount of exposure to the financial markets for your specific time horizon, goals, and comfort level.

There are a handful of extremely simple but important questions all investors must ask themselves. One of them is as rudimental as “what is my time horizon”? Investors need to know if they must turn their portfolios into streams of income, gifts, purchases, or whatever, in a matter of a year, 5 years, 10 years; or if their portfolio is just designated as a legacy at this point in their lives.

As simple as this sounds, I’ve been in this field for nearly 30 years, and I can tell you this question has always tripped people up. They have a bad habit of thinking they have a long time horizon right up to the point when the markets start to get shaky. Next thing you know, they are worried about where things will be in a matter of a few months. Why? It’s purely a quest for emotional comfort.

But that’s not the way the markets work. If it was always comfortable, the returns over time would be nowhere near what they’ve proven to be. It’s all about risk versus reward. Comfort is for the CD or Treasury Bond money, it’s not for the stock market.

If you are investing for long-term benefits, multiple months stretches in the markets are theoretically meaningless. This doesn’t mean you ignore market fluctuations or invest with reckless abandon. But if a patch of tumultuous months lead to an overwhelming sense of tension, it’s a clear sign you have too much exposure to the markets.

Could it be that you’ve confused your savings money with your investment capital?

Since the initial theme of this note was that ambiguity is everywhere and doesn’t really help investors make wise decisions, let me abundantly clear.

If you have money in the markets that you will need to use for any reason in the next 6 months, for example, get it out. The time horizon of that money is too short to be doing anything other than speculating on the random nature of the short-term. But if you have money in the markets that is dedicated to the purpose of growing your nest egg for the future; either your own or that of your heirs, these are the periods we all must endure to benefit from the higher risks of stock-related portfolios relative to savings accounts.

Said another way, these are the times that we pay what I refer to as the ‘emotional tax’ for long term growth.

I do believe long term growth is still coming. But let me again be clear about my expectations.

These are not going to be timid times in the markets. I would suspect that the current weakness in the markets is likely to continue. Do not confuse this with a prediction of calamity or a long season of deep declines. That’s not my opinion. I just don’t think the markets will immediately bounce back up to their old highs. But I do expect them to return and surpass those old highs in the foreseeable future. In the meantime, I wouldn’t be at all surprised by an extended period of volatile consolidation.

Just because the volatility of the past several months is not about to stop, it doesn’t mean it is derailing the upward trajectory of the markets for the years ahead. Simply put, we need to be honest with how markets work.

They are being more truthful to their history now than what they have been for the past few years when volatility was essentially non-existent. A sharp look at history shows that 10% corrections happen routinely in markets. In fact, they happen closer to two times every year. In recent times, investors might have been led to believe they happen only on rare occasions, say, once in 5 years or so.

In other words, there is no problem that needs to be corrected in the markets. No government agency needs to interfere as these free markets price in new realities about interest rates, inflation, and earnings projections going forward.

From my perspective, they are not telling you that calamity is on the horizon. They are saying that a rest is in order.

Let’s look at similar situations in the past to give this some additional perspective. It would be right to look at years like 2011, 2015, and 2018. Those were each tumultuous years that served as excellent rests for the long running upward trend in the market. Making money on financial assets just basically did not happen in those specific years. But those years served the important purpose of maintaining the underlying health of the markets for money to be made in the long trend.

So we have to ask ourselves if we believe 2022 is another resting year that connects phases of an upward trend, or if we believe it is the year of runaway inflation that ushers in a severe economic downturn. As I said above, the evidence strongly suggests this is a connection year, not a catastrophe year.

Bouts of market volatility can be seen as emotional checkpoints. They highlight the importance of moderation, and they remind us of the critical distinction between investment and savings accounts, between our long-term capital and our rainy-day funds.

The biggest mistake investors tend to make is focusing too much on the short-term. This risk is heightened if they haven’t adequately separated their short-term capital from their long-term capital. It has been rightly said that the stock market is a device for transferring money from the impatient to the patient. You need to position yourself to be as patient as possible and not vulnerable to market tantrums.

Short-term capital should not be invested. Not now, not ever. Investors that know they have only long-term capital exposed to the markets are in far better positions to maintain their perspective during volatile times. They can better restrain their emotions in both good and bad moments.

These current market conditions might be tempting some folks to be aggressive and look to buy cheap assets that are positioned to rebound dramatically. In my mind, this is excessively aggressive and not something I’d encourage. But at the same time, these are not times to be pessimistic or be led to believe the sky is falling.

The truth, as it typically does, resides in between these extremes.

Long-term investors should be comfortable in maintaining their exposure to the markets now. There’s no need to get too cautious or too gutsy.

And to whatever extent money is needed to be spent in the next year or less, those funds should be out of the markets and resting comfortably in a savings account. This safeguards not only the money that is to be spent in the short-term, but also greatly boosts the probability of success through better perspective on the longer-term investment capital that can be left to work with less mental anguish brought about by sometimes shocking market gyrations.

The Takeaways:

- Please take a few moments for some reflection on your overall finances. If you feel like you have somehow comingled your short-term and long-term capital in the markets, take the necessary action to safeguard your short-term needs and stop them from interfering with your proper perspective on your long-term assets.

- Should this current news cycle stay negative, be careful not to get too pessimistic yourself. Keep the graph about the health of consumers in mind. The US Household’s clean balance sheets added to pent-up Covid demand can mean a much more resilient consumer now than in prior economic cycles.

- For more active traders reading this piece, don’t get too cute. Trading this market can be extremely dangerous. This is always true, but perhaps even moreso in recent years as things happen so much faster in this modern, tech-driven market. This means traders run an even higher risk of being whipsawed now than what they were in the past.

- Universally speaking, it is much more important to properly plan than to properly predict. Yes, I’ve made some light predictions about what I think are the likely next moves of the market, but there’s no way to know if those hunches are correct. My job is far less about guessing right on market moves and much more about planning for the various contingencies. Whether the goal is to fund a major purchase, assure an income throughout retirement, or efficiently pass assets along to others, a solid plan for those goals should be in place to minimize the need for proper market guesses along the way. After all, your peace of mind is to be built by your portfolio, not suffocated by it.

Disclosure

All e-mail sent to or from this address will be received or otherwise recorded by the International Assets Advisory, LLC corporate e-mail system and is subject to archival, monitoring or review by, and/or disclosure to, someone other than the recipient. This information is obtained from sources believed to be reliable; however, its accuracy or completeness is not guaranteed. Investing in securities underlying in currencies other than the U.S. dollar involves certain considerations comprising both risk and opportunity not typically associated with investing in U.S. securities. The security may be affected either favorably or unfavorably by fluctuation in the relative rates of exchange between currencies, by exchange control regulations, or by indigenous economic and political developments. As with any investment, there is no guarantee against potential loss. Past performance is not an indication of future performance. International Assets Advisory, LLC and its affiliates, employees and/or directors may have positions in these securities, and may as principal or agent, buy from or sell to customers. All securities are subject to price and yield change and subject to availability. Mutual funds, Unit Investment Trusts and Variable Annuities are sold by prospectus only. Please read the prospectus carefully for important information about fees and risk considerations.

Securities offered through International Assets Advisory LLC Member FINRA/SIPC. The information provided is based on carefully selected sources, believed to be reliable, but whose accuracy or completeness cannot be guaranteed. Any opinion herein reflects our judgment at this date and is subject to change without notice. This should not be construed as an offer or solicitation to buy or sell securities. Investors should consider the investment objective, risks, and charges and expenses before investing in an investment company product. Stocks, options, and mutual funds are subject to market volatility and the chance that they may lose value. Bonds are subject to changes in interest rates, risks of defaults by issuer, and the loss of purchasing power due to inflation, or the risk that an issuer will be unable to make interest or principal payments. Additionally, bonds and short-term investments entail greater inflation risk than stocks. Any fixed-income security sold or redeemed prior to maturity may be subject to a substantial gain or loss.

Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be either suitable or profitable for a client or prospective client’s wealth management investment portfolio.

This information is not intended to be legal or tax advice. Please consult a tax, legal, or financial professional with questions.

Investing in securities underlying in currencies other than the U.S. dollar involves certain considerations comprising both risk and opportunity not typically associated with investing in U.S. securities. The security may be affected either favorably or unfavorably by fluctuation in the relative rates of exchange between currencies, by exchange control regulations, or by indigenous economic and political developments. As with any investment, there is no guarantee against potential loss. Investments in securities and insurance products are:

NOT FDIC-INSURED/NOT BANK-GUARANTEED/MAY LOSE VALUE