Looking into the New Year and beyond, a bumpy ride higher is the best way to describe my expectations for both the economies and financial markets of most regions of the world.

In past years, I adopted (not invented) the characterization of a Plow Horse for the US economy. The expansion we had as we recovered from The Great Recession was so slow yet steady that the visual of a Plow Horse was perfect. Along came Covid to take the ole horse out to its proverbial final pasture.

The new question has since become whether we continue a post-pandemic expansion phase or if we fall into recession.

As I have contended here before, whether we go into a season that is officially labeled as a recession or not isn’t highly relevant. It’s the way a stagnant economy creates a sense of malaise that affects the psyche and behavior of most consumers that is. And that’s really the heart of today’s questions about the economic outlook. Will growth stay at such anemic levels that we have longer ranging problems on our hands, which would mean more pain for investors?

My base case expectation is that we will see sub-par growth that leads to more malaise than euphoria. But this implies forward movement, nevertheless.

Euphoric conditions are highly unlikely to develop, in my view. The same is true for the rampant predictions of multiple years of misery. In other words, no Race Horse and no Glue Pot. I’d venture to say that a new Plow Horse is on the scene, but this one has shin splints.

So, what does this new animal mean for investors?

I believe it means we need to have realistic expectations about exactly how much growth can be had; but also that growth can indeed be expected. I do not believe we are in the early stages of a multi-year bear market. However, now is not the time to dream about big market returns simply because things have dropped this year. While it is true the market is more attractive after down spells, it doesn’t mean things are so cheap now that excessively high returns are right around the corner. I simply don’t believe that’s the case. This is also not the time to run and hide from markets for fears of today’s lousy market being tomorrow’s same lousy market. This recency bias stings identically when we believe good or bad markets will last forever. Neither is true.

My belief that a bumpy road ahead is shaped partly by the current preponderance of mixed signals.

While inflation is still high by any measure, several historically key metrics of inflation inputs have started to moderate and even trend lower lately. Unfortunately, they have not shifted so strongly to create enthusiastic confidence. It is still debatable whether these positive trends take hold or if they are merely pauses. Will oil prices continue to move lower? Will global supply chains continue to come back online? Will the government’s printing press stay less active? Will most raw commodity costs continue to come down, and will wage pressures continue to abate? You can only imagine the debates around most of these topics – and this is by no means a complete list of debatable inflation data points!

Other mixed signals are seen in stock valuations. By some measures, markets have returned to fair values, or even entered undervalued territories. That would be encouraging were it not for the fact that other measures with just as much historical accuracy say the market is still expensive.

For example, according to S&Ps numbers in November of 2021, the P/E ratio of the 20 largest stocks in the index was 28. Those same 20 stocks now have a P/E ratio of 18.

When you exclude those largest 20 stocks from the rest of the index, the P/E ratio in November of last year was 19. It is now closer to 16.5.

Is the market less expensive? Yes. Is it inexpensive? History would suggest not.

Of course, there’s a debatable message from the bond markets, too. At the moment, the yield curve is inverted – meaning that yields are higher on shorter term bonds than on longer term bonds. In fact, the inversion between 2 year and 10 year government bonds is the widest it has been since 1981. This is a very powerful indicator of a recession on the horizon and doesn’t seem like it would fall into the ‘mixed’ camp. But there are notable bond managers with excellent track records putting forth the notion that they don’t believe the bond market is telling its usual story. They commonly cite the war between Russia and Ukraine as the reason. Their contention is that bond market readings are distorted by wide-ranging variables of the duration and nature of the war. They believe that if the war were to end sooner rather than later, we’d see this inversion evaporate rather quickly. This would mean the message of the inversion is more geopolitical than economic, which could render it a false positive for a recession and could prove costly for investors who grow too negative. Regardless, the bond market’s history of taking the temperature of the real economy is quite good. No matter how the war plays out and what it might mean for the accuracy of the current bond market signal, I think it’s fair to say that whatever the future pace of economic growth will be, the most optimistic folks are likely to be disappointed; future economic growth will be modest.

These mixed signals largely impact the near-term volatility and direction of the markets. However, they change quickly and don’t necessarily say much about the intermediate and longer-term outlook. The best ‘to-do’ list for investors doesn’t change quickly and it certainly hasn’t changed throughout 2022.

Specifically, investors need to first be sure they have enough cash on hand to allow them to view their portfolios as longer-term holdings and not as sources of capital for large expenses within a one-year time frame. Short term money like that should always be in a savings account, not an investment account. Having this cash reserve in place gives investors one of their most important tools: perspective.

With the perspective we gain from knowing our investments are designed for future benefit, patience becomes another great weapon at our advantage. While we’d all love to know the next immediate 5% swing direction of the market, we don’t. Nobody does. From time to time we can guess it right. But that’s no way to win the long game. Patience beyond the market’s gyrations is a must have for long-term success.

When we combine perspective and patience, realistic expectations have the best chance of being met. The tone I’m hoping to strike with the message in these pages is that expectations going forward should be positive, just not radically so. We are not likely on the dawn of dramatically above average economic growth or stock market returns. We’re also not likely on the dawn of financial Armageddon.

Consider that the first decade of this century has been dubbed the “Lost Decade”. Marred by two deep recessions, the S&P 500 had essentially a flat (0%) return for the entirety of that period. This historically horrible interval ushered in one of the historically stronger ones. The second decade of the century provided compounded returns of the S&P 500 just shy of 13.4%. Very weak to very strong. Given this, I wouldn’t be surprised if this third decade splits the difference. This is a factor of current economic conditions and good old-fashioned regression to the mean math.

Another way to look at the numbers is that the first 20 years of the century produced a compounded rate of return of 6.49% from the stock market, as measured by the S&P 500. It just produced those returns in a bi-polar fashion. My outlook augers for this decade to produce roughly a similar return in and of itself. That would mean a radically bad phase led to a radically good phase, which is likely to lead to a radically average one. The bottom line is that realistic expectations shouldn’t be set at 0% or 10%+. Mid-to-upper single digit returns for the foreseeable future seems sensible to me.

Is it possible for portfolios to exceed those baseline index expectations? I’d say yes, and there are a few reasons for that.

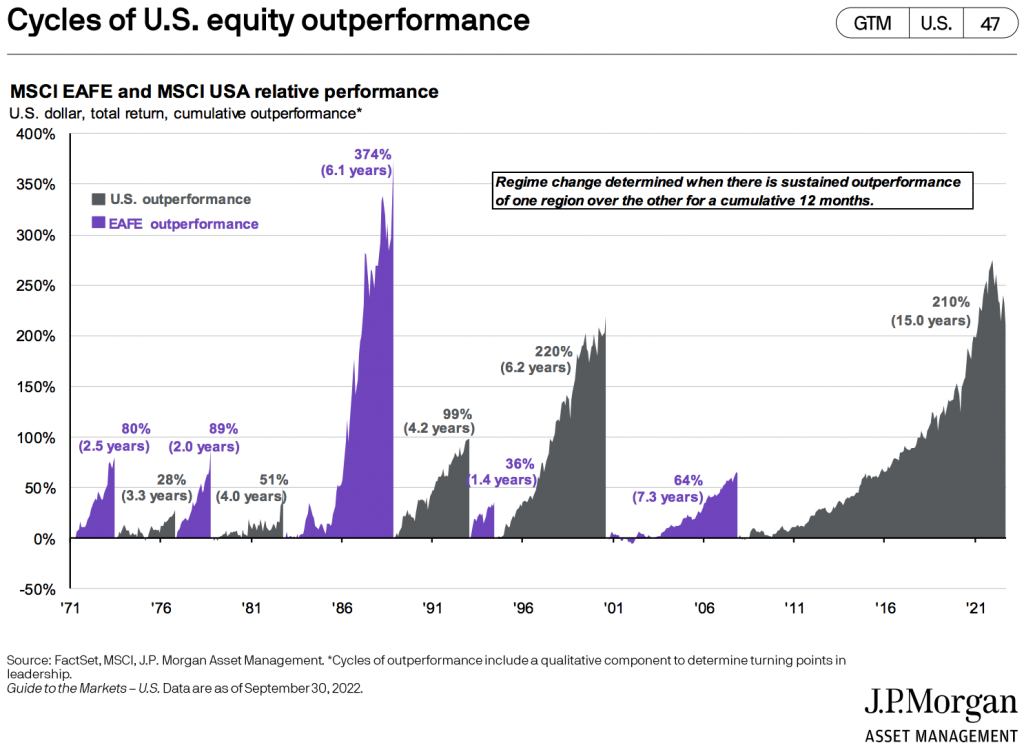

Market moves like the one we’re enduring now allow opportunities to emerge. One potential opportunity is in the international markets. The danger here is that this area has been a potential opportunity for a while. As the graph below from JP Morgan shows, US outperformance has lasted an unusually long time. This trend simply won’t last forever. Yes, the United States has the most vibrant, resilient, and innovative economy in the world. It’s my opinion that our markets should almost always be priced at a premium to the rest of the world for those reasons. But this spread is very stretched now. This is mostly due to the strength of the US dollar in recent years. This strong dollar has been a millstone around the neck of the international markets. Data is now starting to show that the peak of the dollar may have been achieved. If this trend continues, it is likely to be long running. It would also be a very powerful tailwind for international stocks and years of dramatic underperformance could reverse.

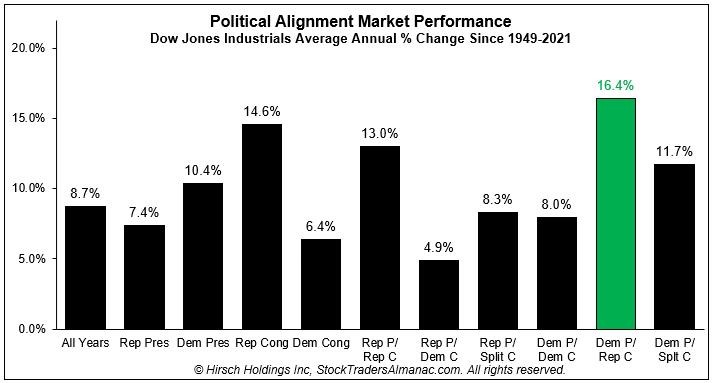

Broadly speaking, the US markets do have another historically proven source of optimism. I’m talking about gridlock in Washington. Please remember that comments here are with respect to financial markets. I realize there are some reading this who are thrilled with the results of the election and others who are not. That, by the way, will be the same after the next election, the one after that, and so on until the end of time. But what does gridlock tend to mean for financial markets? Good things.

As the following chart from the Stock Trader’s Almanac shows, gridlock is one of investor’s best friends. I’ve looked at this from every angle in terms of which party is gaining stature and which is losing. I’ve gauged the starting points to test them against all sorts of variables including economic backdrop, stock prices, unemployment, etc. The results are always the same with only minor changes. Any way you judge it, gridlock has been good for the economy and asset prices. Perhaps not immediately, but in the fullness of election cycles.

Not to over-emphasize the point, but one good example would be the investors in Berkshire Hathaway. For fun, I went back in history to look at how many times Berkshire fell at least 20% since its inception. I started in the current day and worked backward in time. I gave up. I stopped counting after the 20th occurrence, and I was a long way away from its inception. A very long way!

My point is simply that dips happen, even to the highest quality assets. This has been a unique year in that dips happened across the spectrum of stocks, bonds, commodities, real estate, etc. Assets that typically behave differently from one another didn’t and diversification strategies that are designed to dampen volatility had their worst year in history in some cases.

The good news? Simply stated, this means the probability of a repeat occurrence of this year looks a lot like lightning striking twice.

The Takeaways:

- The Plow Horse with Shin Splints is here. It may not be pretty, but it gets the work done. Translation – very slow economic growth is most likely in our future. This gives an upward bias to stock prices, but no reasons to be overly enthusiastic.

- One of my favorite sayings is “do the right things long enough”. It applies to just about everything in life. Saving and investing are perfect examples. I find that we all know the right things to do, but we don’t do so great on the ‘long enough’ part. Investing in 2022 reminds us that we need to continue on long enough to reap the benefits of being investors.

- Remember that this Worth Considering piece is not a White Paper in which I can do deep dive analyses or recommend specific investments. There are loads of compliance restrictions adding to the fact that most readers would prefer more condensed highlights. I always welcome anyone who would like to explore my thoughts in more detail to give us a call. I will always be happy to go into as much detail as anyone might like.

Disclosure

All e-mail sent to or from this address will be received or otherwise recorded by the International Assets Advisory, LLC corporate e-mail system and is subject to archival, monitoring or review by, and/or disclosure to, someone other than the recipient. This information is obtained from sources believed to be reliable; however, its accuracy or completeness is not guaranteed. Investing in securities underlying in currencies other than the U.S. dollar involves certain considerations comprising both risk and opportunity not typically associated with investing in U.S. securities. The security may be affected either favorably or unfavorably by fluctuation in the relative rates of exchange between currencies, by exchange control regulations, or by indigenous economic and political developments. As with any investment, there is no guarantee against potential loss. Past performance is not an indication of future performance. International Assets Advisory, LLC and its affiliates, employees and/or directors may have positions in these securities, and may as principal or agent, buy from or sell to customers. All securities are subject to price and yield change and subject to availability. Mutual funds, Unit Investment Trusts and Variable Annuities are sold by prospectus only. Please read the prospectus carefully for important information about fees and risk considerations.

Securities offered through International Assets Advisory LLC Member FINRA/SIPC. The information provided is based on carefully selected sources, believed to be reliable, but whose accuracy or completeness cannot be guaranteed. Any opinion herein reflects our judgment at this date and is subject to change without notice. This should not be construed as an offer or solicitation to buy or sell securities. Investors should consider the investment objective, risks, and charges and expenses before investing in an investment company product. Stocks, options, and mutual funds are subject to market volatility and the chance that they may lose value. Bonds are subject to changes in interest rates, risks of defaults by issuer, and the loss of purchasing power due to inflation, or the risk that an issuer will be unable to make interest or principal payments. Additionally, bonds and short-term investments entail greater inflation risk than stocks. Any fixed-income security sold or redeemed prior to maturity may be subject to a substantial gain or loss.

Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be either suitable or profitable for a client or prospective client’s wealth management investment portfolio.

This information is not intended to be legal or tax advice. Please consult a tax, legal, or financial professional with questions.

Investing in securities underlying in currencies other than the U.S. dollar involves certain considerations comprising both risk and opportunity not typically associated with investing in U.S. securities. The security may be affected either favorably or unfavorably by fluctuation in the relative rates of exchange between currencies, by exchange control regulations, or by indigenous economic and political developments. As with any investment, there is no guarantee against potential loss. Investments in securities and insurance products are:

NOT FDIC-INSURED/NOT BANK-GUARANTEED/MAY LOSE VALUE