As we rush headlong toward the end of another year, we are hearing from the major investment banks with their predictions for the markets for the year to come.

By and large, it’s an optimistic crowd.

Deutsche Bank currently occupies the high ground with a forecast of 8,000 by the end of next year.

Not far behind are Morgan Stanley at 7,800, RBC at 7,750, Goldman Sachs at 7,600, and JP Morgan at 7,500. Those are levels between 10% and 18% higher than today.

A more cautious tone was struck by Bank of America at 7,100, which is closer to 5% above the current market.

Even though these are predictions for more than a full year out, it’s normal for these analysts to factor the recent Thanksgiving season into their calculations. They are looking for a read on the strength of the consumer as they weave data like air travel, box office receipts, and Thanksgiving weekend online sales into their underlying views of the overall economy and corporate earnings growth.

This year’s data supports their confident stances.

Adobe Analytics, a leader in U.S. e-commerce insights, reported a record-breaking $44.3 billion in online sales over Thanksgiving weekend. This represents a 7.7% increase over last year’s record.

For investors, this is all very encouraging.

My message today doesn’t take issue with this consensus, but it does temper it somewhat.

In my view, there are valid reasons for confidence looking at the year(s) to come. But there are also reasons to curb the enthusiasm.

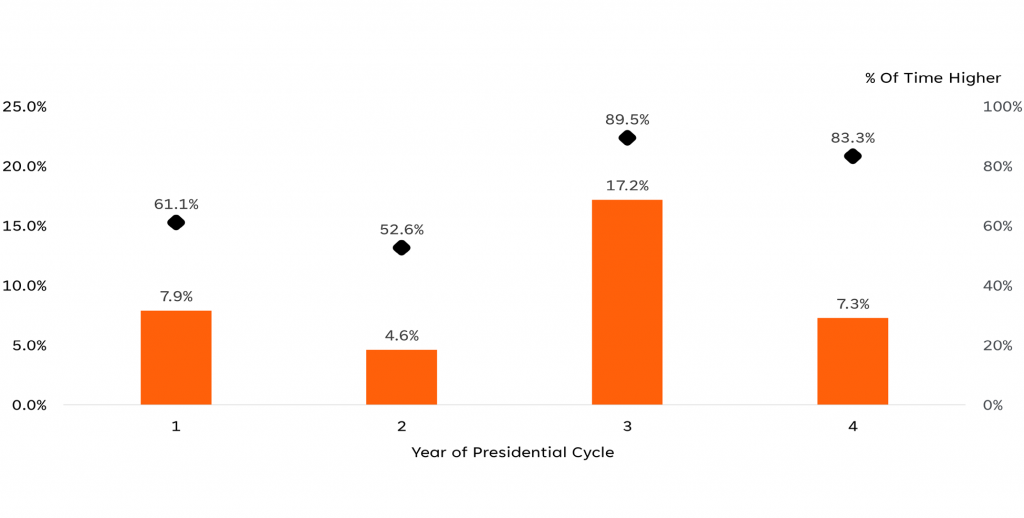

For starters, an often-overlooked historical fact is that the 2nd year of the Presidential term is the lowest performing year for financial markets. If history is a useful guide, not only would 2026 be a more challenging year for market gains, but it would also hold more 5-10% market dips than average.

This isn’t a bearish forecast. The expectation is just a more difficult year within a longer running upward trend. The message is also that the type of year we may have ahead could be more nerve-wracking for someone without a proper plan in place.

Note this simple graph built by the research firm FactSet. You’ll see that historically, we are entering the softest phase for markets in terms of the Presidential cycle. This particular graph includes data from 1950-2024, but the fact holds going back to 1900.

S&P 500 Index Average Yearly Returns (1950 – 2024)

Does this mean investors should be afraid? I’d say no. While I believe all economic and historical data need to be contextualized to be valuable, this simple visual provides one reminder that markets don’t move in straight lines, and we investors need to at least be aware of a phenomenon that has held true for more than a century.

To be clear, my base case expectation is that financial markets will be higher in the years ahead. That base case also includes more frequent bouts of turbulence than we’ve recently seen, as well as a more moderate pace of ultimate growth than what we’ve seen in recent years.

This expectation of more modest rates of growth with more frequent dips in the upward trend isn’t an anxious or negative stance. I simply believe it is the most logical given the current values of assets and the nature of the risks that lie ahead.

The market is on the high side of its historically average valuation metrics, which can be likened to running uphill. Predictable progress can still be made, but it is simply slower.

And what if some of the assumptions that are being priced into today’s markets don’t come to fruition?

Certain outcomes are being assumed about everything from the path of interest rates under a new Fed Chair to the never-ending investments being made in the field of Artificial Intelligence. What if the year ahead doesn’t play out as expected on those fronts, or with the mid-term elections, for that matter? Goodness knows 11 months is a lifetime in today’s political climate; so how predictable is a truly representative and fully functioning House and Senate? And how might the markets behave as the DC rancor ramps up throughout the summer?

There are a host of reasons to approach the year ahead with a hint of Bank of America’s caution, or even worse.

Likewise, there are ample reasons for optimism. The markets do indeed have some potential tailwinds to push them along. The most likely scenario is that AI will continue to be a high growth investment theme and that interest rates will work their way lower throughout the year.

Beyond these unknowable aspects of the future there are some compelling current realities.

One of which is that the broadening theme is slowly taking hold within the market. While they’ve all done well, only 2 of the Mag 7 have outperformed the broader market this year – Google and Nvidia. As I’ve suggested time and again, this is a healthy development.

As the market leadership extends beyond just a handful of companies, the market’s upside potential is unchanged while its overall level of risk is reduced. That is an enviable combination, for sure. This process of rotation also extends the life of the market’s upward trend. Slowly but surely, this is happening under the surface.

So, while the media may still be enamored with the narrow list of mega-cap tech companies that have been in control of the market for so long, we investors are more interested in seeing their days of dominance come to an end. As I’ve written before, those leaders don’t need to fail for this virtuous rotation to take place. Instead, investors should take some profits from past market leaders and redirect that capital into the many companies operating far better internally than their stock performance suggests since they have been overlooked by recent market darlings.

Value does exist in a lot of stocks outside the top 20 or so in size, and let’s not forget that we’re seeing strength in both economies and stock markets around the world still. After being in the doldrums for so long, foreign markets may be a bright spot for a while to come.

These are just a few of the pebbles that are on the optimist’s side of the scale as we glance beyond 2025.

But there are plenty of speedbumps on this road; it isn’t at all a nicely paved highway built for speed. Rather, it’s a winding road through the mountains and sometimes it’s difficult to see the guardrails that protect us from the cliffs.

This speaks to the importance of having a bigger picture plan to rely on and not just some forecasts that are rife with all sorts of “if/then” justifications that can be walked back by a Wall Street community well versed in explaining why the market got it wrong and not them.

Your portfolio, your income needs, and your estate plans don’t care. But if you have a plan for all outcomes, you can listen to the stories with relative calm.

Having been in this industry for 30+ years, I’ve seen strategists mangle facts in all sorts of ways to retrofit a faulty prediction. It’s career protection for them, and if your retirement isn’t tethered solely to those guesses, it’s fairly entertaining to watch!

The previous edition of Worth Considering (click here) was dedicated to the importance of financial planning and included an extensive list of things to consider and address. I’d encourage you to review that piece and be sure you’ve got those aspects of your house in order. Given my belief that the financial markets will be meandering higher on the horizon, it isn’t anywhere near as important to guess where the S&P 500 will be in a year as it is to know your income will be stable, your assets are secured, and you’re in the proper position to endure the inevitable periods of market weakness that may embarrass analysts. Or worse, damage the financial stability of those who felt these market predictions are more valuable than things like their overall allocations, portfolio tax efficiency, or contingency planning in true times of stress

The takeaways:

- Market forecasts are optimistic but uncertain.

Major banks predict solid gains for next year, supported by strong consumer data, yet historical patterns—especially the typically weak second year of a Presidential term—suggest more volatility and slower progress. - The market outlook is positive but uneven.

While long-term growth is expected, higher valuations, political unpredictability, and assumptions about interest rates and AI pose risks that could challenge the consensus. - Market leadership is broadening, which is healthy.

With only a few mega-cap tech names outperforming this year, more companies are beginning to contribute to market strength, reducing overall risk and extending upward trends; investors may benefit from reallocating profits from past leaders into overlooked, fundamentally strong businesses. - Planning matters more than predicting.

Because markets rarely move in straight lines and forecasts often miss the mark, a solid financial plan—covering income needs, allocation, risk, and contingencies—is far more valuable than relying on Wall Street predictions.

Disclosure

Securities offered through International Assets Advisory, LLC (“IAA”) – Member FINRA/SIPC. Advisory services offered through International Assets Investment Management, LLC (“IAIM”) or Global Assets Advisory LLC (“GAA”) – SEC Registered Investment Advisor(s). IAA, IAIM, and GAA are affiliated entities.

The information provided is based on carefully selected sources, believed to be reliable, but whose accuracy or completeness cannot be guaranteed. Any opinion herein reflects our judgment at this date and is subject to change without notice. This should not be construed as an offer or solicitation to buy or sell securities. This information is not intended to be legal or tax advice. Please consult a tax, legal, or financial professional with questions.

Investors should consider the investment objective, risks, and charges and expenses before investing. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be either suitable or profitable for a client or prospective client’s wealth management investment portfolio. Past performance is not an indication of future performance. International Assets Advisory, LLC and its affiliates, employees and/or directors may have positions in these securities, and may as principal or agent, buy from or sell to customers. All securities are subject to price and yield change and subject to availability. Investments in securities and insurance products are: NOT FDIC-INSURED/NOT BANK-GUARANTEED/MAY LOSE VALUE. Stocks, options, and mutual funds are subject to market volatility and may lose value. Mutual funds, Unit Investment Trusts and Variable Annuities are sold by prospectus only. Please read the prospectus carefully for important information about fees and risk considerations. Bonds are subject to changes in interest rates, risks of defaults by issuer, and the loss of purchasing power due to inflation, or the risk that an issuer will be unable to make interest or principal payments. Additionally, bonds and short-term investments entail greater inflation risk than stocks. Any fixed-income security sold or redeemed prior to maturity may be subject to a substantial gain or loss. Investing in securities underlying in currencies other than the U.S. dollar involves certain considerations comprising both risk and opportunity not typically associated with investing in U.S. securities. The security may be affected either favorably or unfavorably by fluctuation in the relative rates of exchange between currencies, by exchange control regulations, or by indigenous economic and political developments.